Nelson Chang’s Seven Years of Low-Carbon and International Expansion for Taiwan Cement, Earthquake Impact Doesn’t Deter April Revenue and Continued Profitability

Nelson Chang’s Seven Years of Low-Carbon and International Expansion for Taiwan Cement, Earthquake Impact Doesn’t Deter April Revenue and Continued Profitability

2024.05.21

-

Copied

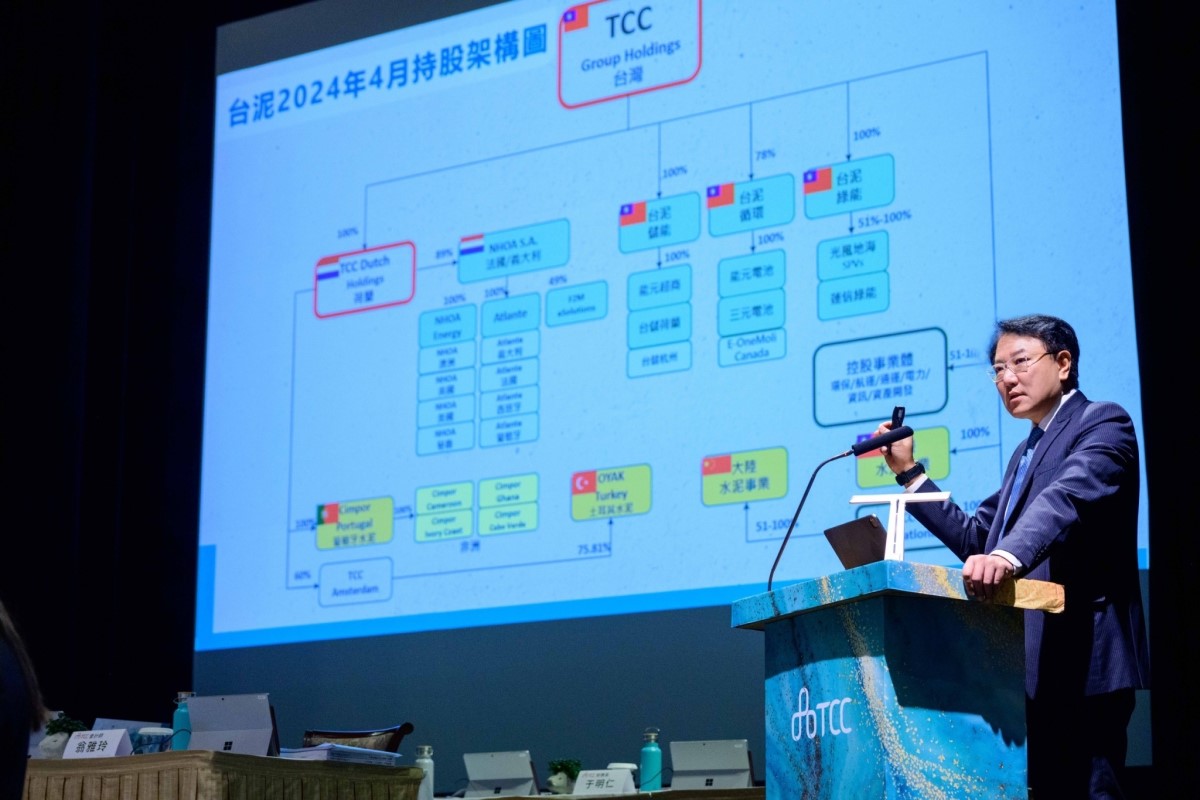

On the 21st, TCC held its shareholders’ meeting to elect directors, followed by the board of directors re-electing Nelson Chang as Chairman. When Nelson Chang took on the role in 2017, Taiwan Cement had 16 major subsidiaries primarily serving the cement industry across the Taiwan Strait. Fast forward to 2024, and Taiwan Cement has expanded to 27 major subsidiaries spanning 11 industries, with employees representing 47 nationalities. The company’s market value has grown by 95% since 2017.

Nelson Chang has led TCC’s seven-year journey toward low-carbon transformation, emphasizing that “we are on the right path, and we are not alone.” He firmly believes that carbon reduction and economic development can coexist. This forward-looking vision is reflected in the company’s continued profitability. Despite challenges such as heavy rain affecting facilities in Hualien and Guangdong, TCC’s combined revenue for April remained positive. Nelson Chang stated, "Our self-reported numbers show profitability, although the final figures will be verified by accountants. Even when our traditional core industries face production challenges and losses, new ventures can sustain our revenue and profits.

During shareholders’ meeting, Nelson Chang likened the atmosphere to an “exam day.” He expressed optimism about cement markets in Turkey, Portugal, and Africa this year, believing they can yield reasonable returns for Taiwan Cement. In Turkey, post-earthquake reconstruction demands high cement consumption due to legal requirements for demolishing older buildings. OYAK, a Turkish cement company, leads in profitability, surpassing the second-ranked competitor by nearly 10%.

Regarding the mainland China cement market, Nelson Chang explained that global cement consumption correlates significantly with GDP growth. However, cement consumption eventually reaches a plateau, followed by a decline before rebounding. Cement, being a necessity, ensures the industry’s permanence. Although mainland China currently lacks carbon pricing, Taiwan Cement anticipates that carbon pricing will enhance their product competitiveness. The company will continue operations in the mainland market, adjusting kiln usage and even closing less promising facilities over the next 12 to 18 months.

Addressing shareholder concerns about TCC’s investment in lithium-ion batteries, Nelson Chang emphasized that battery development, like semiconductors, requires rigorous in-house processes, including AI-driven process improvements. Molicel,TCC’s battery brand, has grown exponentially, with prices nearly 2.5 times higher than mainland China due to superior characteristics. While May revenue for Molicel leveled off, June saw profits, albeit not substantial. Nelson Chang urged shareholders to understand that battery research and development is essential. Molicel’s rapid factory construction in Xiaogang sets a record, but achieving high yields takes time. Taiwan needs new industries, and batteries are one such example. Notably, Molicel batteries power over half of the world’s advanced eVTOL aircraft and numerous supercars.

Regarding EnergyArk, Taiwan Cement’s cement energy storage solution, Nelson Chang revealed plans to develop the European and mainland Chinese markets. Requests for quotes have already come from France, Italy, Portugal, and the Netherlands. Local production facilities are crucial for sustainable growth. NHOA, acquired in Europe, has exceeded expectations, with 2023 revenue reaching €273 million, a 65% growth compared to 2021. The 2 GWh energy storage project at Atlante 4111, set to launch in Q1 2024, received €73 million in EU subsidies. TCC’s accumulated experience in power trading, combined with EnergyArk and NHOA, will drive European market development. During today’s shareholders’ meeting, Chairman Nelson Chang expressed his thoughts. TCC, once a traditional industry, faces the question of whether R&D is necessary. While the past 20 years didn’t emphasize R&D, the future demands it—especially for low-carbon products. Achieving net-zero emissions by 2050 requires a 30% reduction by 2030. Nelson Chang acknowledged that R&D doesn’t yield immediate profits, but it’s essential. The company must allocate resources for research, even if it means using smaller funds to pave the way forward.

Addressing shareholder concerns about GDR (Global Depository Receipt) issuance, TCC’s General Manager, Roman Cheng, emphasized that GDRs are crucial international fundraising tools for all Taiwanese listed companies. In 2022 and 2023, Taiwanese companies raised $2.1 billion and $1.2 billion, respectively, through GDRs. In Q1 of this year, Taiwan already issued $1.4 billion in GDRs, with plans for an additional $4 billion. Historically, GDRs have an average discount of 7.3%, compared to domestic cash capital increases averaging 15-20%. The dilution effect on existing shareholders can be managed.

Between 2023 and 2024, TCC received its first BBB- rating from global rating agency Fitch, with a stable outlook. Meanwhile, Taiwan Ratings upgraded the company’s liquidity to “extremely robust.” Considering these factors, the shareholders’ meeting approved fundraising through both domestic and international capital markets. The decision will be carefully evaluated and announced after board approval.

More Related Information

-

2024.05.21Taiwan Cement Corporation Announces Transformation into TCC Group Holdings Diversifying Beyond Cross-Strait Cement, Aiming for a Balanced and Diverse Revenue Stream

2024.05.21Taiwan Cement Corporation Announces Transformation into TCC Group Holdings Diversifying Beyond Cross-Strait Cement, Aiming for a Balanced and Diverse Revenue Stream -

2024.05.21Chairman’s Remarks for 2024 Shareholders Meeting Taiwan Cement Corporation (TCC)

2024.05.21Chairman’s Remarks for 2024 Shareholders Meeting Taiwan Cement Corporation (TCC) -

2024.05.10TCC's Heping Plant to Resume Processing Hualien City Waste by End of Month. Aftermath Anxiety Persists, TCC Provides Shelter for Elders Afraid to Return Home

2024.05.10TCC's Heping Plant to Resume Processing Hualien City Waste by End of Month. Aftermath Anxiety Persists, TCC Provides Shelter for Elders Afraid to Return Home