Taiwan Cement Corporation Announces Transformation into TCC Group Holdings Diversifying Beyond Cross-Strait Cement, Aiming for a Balanced and Diverse Revenue Stream

Taiwan Cement Corporation Announces Transformation into TCC Group Holdings Diversifying Beyond Cross-Strait Cement, Aiming for a Balanced and Diverse Revenue Stream

2024.05.21

-

Copied

Taiwan Cement Corporation (TCC) held its shareholders' meeting today (21st), officially announcing the transformation of the 78-year-old company into a group holding company, shifting its English name from Taiwan Cement Corporation to TCC Group Holdings. This marks a significant leap into 11 industries, spreading its presence across 13 international markets. TCC's Chairman, Nelson Chang, highlighted that 60 years ago, TCC operated as a cement-only supplier. 60 years later as of today, TCC has advanced itself to become a developer of low-carbon building materials, resource recycling and green energy at the same time. Nelson Chang pointed out that TCC has developed four main revenue pillars beyond Taiwan and Mainland China, including Europe, Africa, and new energy sectors, describing the company's 2023 financial statement as diversified, risk-managed, innovative, and cash-flow positive.

In 2017, over 80% of TCC's revenue still originated from the cross-strait cement market. Nelson Chang mentioned that the company foresaw the plateauing of the Mainland China market after reaching its peak and thus began to explore markets beyond the strait. This led to a joint venture with Turkey's OYAK and, through Portugal's Cimpor, the acquisition of ultra-low carbon alternative fuels in Africa. TCC has pioneered the production of ultra-low carbon cement using calcined clay as a substitute for clinker, leading the global cement industry. As of 2023, 45% of its profits come from its low-carbon cement operations in Europe. In November last year, TCC decided to expand its investment in the low-carbon cement market across Europe, Asia, and Africa, solidifying a stable third pillar for its operations. The company's active engagement in green energy, energy storage, smart grids, and high-power lithium batteries over the past six years is seen as extending TCC's reach into the future, ensuring stable profits and accumulating cross-disciplinary patents and technologies. Nelson Chang described the new energy sector as the fourth pillar supporting TCC's transformation and evolution.

Nelson Chang also referenced global examples like MOTOROLA, the first company to introduce mobile phones, which was split and sold in 2011, and TOSHIBA, which ended its 74-year listing on the Tokyo Stock Exchange in 2023, to emphasize the importance of adapting to global, technological, and societal changes for sustainable business operations. He noted that cement remains as crucial as ever for rebuilding in the aftermath of disasters, such as the level 7 earthquake in Taiwan, and in the era of carbon pricing, low-carbon building materials will be a key competitive advantage for TCC.

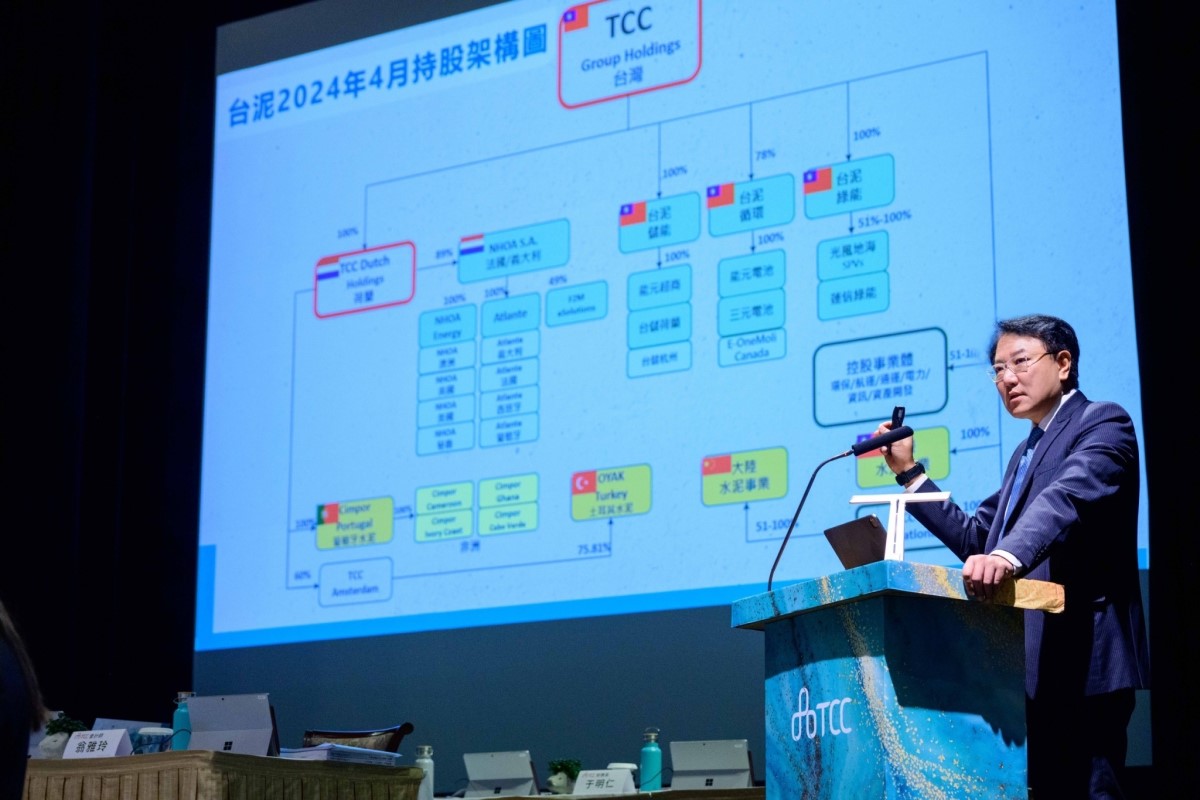

TCC's General Manager, Roman Cheng, explained at the shareholders' meeting that through its holdings in the Netherlands, Turkey, Portugal, and Africa, TCC aims to hedge against currency risks. Despite inflation and currency fluctuations in Turkey, TCC's financial impact is controllable. After expanding its stakes in Turkey and Portugal, TCC has established four major cement bases globally, ensuring stable net cash inflows. Roman Cheng stated that the Netherlands has become a new holding platform for TCC's overseas development, focusing on low-carbon cement, energy storage, and charging stations across Europe, Australia, the UK, the US, and Peru in South America, , complementing TCC's energy storage business in Taiwan, Hangzhou in mainland China, and the Netherlands in Europe.

Roman Cheng detailed that in 2022, TCC's consolidated revenue was NT$113.9 billion, with cross-strait cement accounting for 68%, energy and power for 29%, and others for 3%. In 2023, with the Turkish and Portuguese investments, the projected consolidated revenue is expected to reach nearly NT$160 billion, with cross-strait cement dropping to 43%, Turkish and Portuguese cement at 31%, and energy and power at 24%. This diversification reduces reliance on single markets, enhancing operational flexibility and stability. The revenue share from Mainland China is expected to decrease from 44% in 2022 to 25% in 2023, with Taiwan's share dropping from 53% to 40%. TCC's market share in Taiwan is 32%, 1.69% in Mainland China, 16% in Turkey, and over 50% in Portugal, with less than half capacity utilization, indicating TCC's strong production capacity in low-carbon cement, especially in Portugal and Africa.

More Related Information

-

2024.05.21Chairman’s Remarks for 2024 Shareholders Meeting Taiwan Cement Corporation (TCC)

2024.05.21Chairman’s Remarks for 2024 Shareholders Meeting Taiwan Cement Corporation (TCC) -

2024.05.10TCC's Heping Plant to Resume Processing Hualien City Waste by End of Month. Aftermath Anxiety Persists, TCC Provides Shelter for Elders Afraid to Return Home

2024.05.10TCC's Heping Plant to Resume Processing Hualien City Waste by End of Month. Aftermath Anxiety Persists, TCC Provides Shelter for Elders Afraid to Return Home -

2024.05.08TCC Supports Carbon Pricing and Urges Imported Goods to Declare Embedded Carbon for Taiwanese Version of CBAM

2024.05.08TCC Supports Carbon Pricing and Urges Imported Goods to Declare Embedded Carbon for Taiwanese Version of CBAM